Ann Arbor City Budget: Cuts Begin Now

Ann Arbor city administrator Roger Fraser talks with city councilmembers about upcoming budget decisions. That possibility includes layoff notices to 14 firefighters to be sent as soon as the week of Dec. 7. Members of the International Association of Firefighters Local 693 stand in the background. (Photos by the writer.)

Unless he receives other direction from the Ann Arbor city council at its Dec. 7 meeting, city administrator Roger Fraser told councilmembers at their Saturday budget retreat that he’ll begin implementing a plan to trim around $3 million out of the current fiscal year budget.

The moves are necessary to balance the FY 2010 budget, which ends June 30, 2010.

Some of that trimming is a matter of accounting for one-time savings – $500,000 had been budgeted for the Pfizer tax refund, but was settled last year so won’t be on the books for FY 2010. Other trimming is a matter of accepting current situations and committing to them going forward, for recurring savings – for example, vacancies from excess reductions of police through the early-out retirement incentive would not be filled.

But some of the trimming would entail cutting positions currently filled – 14 firefighter positions, which account for around $400,000 of the $3 million to be saved in FY 2010. The move to eliminate firefighter jobs had been part of the FY 2011 plan, but would be implemented six months earlier – now.

For FY 2011, the picture gets even worse, with the city facing a $5.4 million shortfall. And looking ahead one year after that, city council will be faced with constructing a budget for FY 2012 that is 30% smaller than the one they approved for FY 2009.

Background on the Budget Retreat

The Ann Arbor city council holds a budget retreat each year to provide some basic direction to the city administrator on the budget, which is presented to the council in the spring. The council then has an opportunity to amend and adopt that budget for a fiscal year that begins in July. If the council takes no action on the administrator’s budget, then – per the city charter – the administrator’s budget becomes the adopted budget.

Goal of the Retreat: Dialog

Last year, the council’s budget retreat was not held until January. [Chronicle coverage: "Ann Arbor City Council Sets Priorities"] At a budget and labor committee meeting this fall, councilmembers on that committee made it a priority to make sure the budget retreat was held earlier than last year, when scheduling problems had pushed the event into January.

Like last year, the retreat was held at the city’s Wheeler Service Center on Stone School Road. All city councilmembers attended, except for Marcia Higgins (Ward 4).

Stephen Rapundalo (Ward 2), who serves on the council’s budget and labor committee, sketched out the goals for this year’s retreat. It would be short on review of basic background material, he said, so there would be more time to engage in a dialog amongst themselves.

The dialog, it turned out, could be fairly characterized as a candid, at times blunt conversation among councilmembers and staff. Rapundalo set part of the tone for bluntness in his introductory comments, when he described how the time of making piecemeal reductions had petered out and that they were now faced with the need to “amputate part of the institution.”

And later during the retreat, when councilmembers Sabra Briere (Ward 1), Sandi Smith (Ward 1) and Stephen Kunselman (Ward 3) expressed concerns about eliminating firefighter positions, Fraser admonished the council that there was no way to get to the 30% reduction they’d need by FY 2012 “without some steel in your backbones.”

Review of Basic Background

The background that formed the basis of the discussion at the budget retreat had been foreshadowed at the council’s May 11, 2009 working session on the FY 2010 budget, which they approved later that month. At the working session, the specter of possible additional mid-fiscal-year cuts to the FY 2010 budget was raised. At the time it was thought that those mid-year cuts could likely be driven by a possible dramatic drop to state revenue sharing monies. [State revenue sharing is the way the state allocates a portion of the state sales tax to municipalities across the state. Chronicle coverage: "City Budget: Some Cuts Sooner Than 2011?"]

The sales tax revenue shared by the state did drop, starting in October 2009. By decision of the state legislature, the statutory revenue sharing to Ann Arbor was cut by about $850,000. And a decrease in sales tax revenues meant a $310,000 drop in constitutional revenue sharing. Altogether, that results in $1.16 million less for Ann Arbor’s FY 2010 budget. [Chronicle coverage: "State budget update"]

Four months ago, at the Aug. 6, 2009 city council meeting – based on a range of estimates for the drop in state shared revenue, plus other projected revenue declines – the city’s CFO, Tom Crawford, had already sketched out a FY 2010 budget shortfall. The FY 2010 gap forecast in August amounted to around $3.3 million and would necessitate some mid-year cuts. [Chronicle coverage: "Ann Arbor's CFO gives bleak financial report"]

Current Forecasts for FY 2010 and FY 2011

The specific up-to-date forecast provided by Crawford for the current budget year, as well as next year, is as follows [numbers inside parentheses are negative]:

FY 2010 FY 2011

(Millions) (Millions)

November 2009

State shared revenue (1.4) (1.2)

Investment income (0.9) (0.9)

Traffic citations (0.9) (0.6)

and caseload

New development (0.2) (0.2)

review fees

Net revenues from (0.2) (0.1)

new parking meters

Property taxes 0.3 -

Bond user fees - (0.7)

Unresolved lease - (1.7)

with DDA

Forecast worse than (3.3) (5.4)

planned

% of expenditures -4% -8%

FTE equivalent (39) (64)

-

The one “bright” spot in the forecast was that property taxes were actually $0.3 million more than originally budgeted.

A reduction in investment income is a function of the near zero interest rates now available.

Sandi Smith (Ward 1) got clarification from the chief of police, Barnett Jones, that the decrease in traffic citations was due to 24 fewer officers writing tickets – as a part of the FY 2010 budget, an early-out retirement incentive was offered. Officers write an average of 15 tickets per month, Jones said. He would not, he cautioned, tell remaining officers to write more tickets to make up for it.

Roger Fraser, Ann Arbor's city administrator, shows councilmembers the graph reflecting reductions in city staff positions that have been implemented since 2001.

The unresolved lease with the Downtown Development Authority (DDA) in FY 2011 for $1.7 million reflects the fact that no renegotiation of the current parking agreement with the DDA has been attempted.

Under the current agreement with the city to manage the parking system, the DDA is obligated to pay the city $1 million a year for 10 years, starting in 2005, with the city’s option to request a payment of $2 million in any given year – as long as the total amount over 10 years does not exceed $10 million. For the first five years of the contract, the city has requested $2 million, which means that starting in FY 2011, the DDA has no obligation under that contract to pay the city anything more. [Additional background: "DDA Invites City to Discuss Parking Fines"]

Eliminating the DDA was mentioned among possible ideas listed out in the retreat packet, in the spirit of what Fraser described as a “far-reaching attempt to provoke your thinking.”

Revenues: City Income Tax?

On a couple of occasions, Christoper Taylor (Ward 3) pointed out that the entire discussion had focused on the expense side of the equation, with no mention of the revenue side. Fraser clarified that this reflected his belief that there was little enthusiasm on council for exploring the idea of a city income tax. Fraser said, however, that he believed the council owed it to voters to ask them the question before they made the FY 2011 cuts.

The two options that Fraser said should be examined were (i) a Headlee override, which would eliminate the rollback of property millage rates mandated by the Headlee Amendment, and (ii) a city income tax. Either option would require voter approval. One upside to the Headlee override, Fraser pointed out, was that the city would be able to act immediately on the additional revenue. The downside: It would raise only an additional $6.5 million, when the city ultimately faced an $8-9 million problem.

As for the city income tax, it would take longer for the city to be able to act on any additional revenues – there’d be no revenues from that until June 2012, and initial compliance would likely be only in the 70% range, compared to the 90% or better rate that could eventually be achieved.

In terms of estimating the likelihood that a city income tax would pass, Fraser suggested that the city should invest in a study of voter attitudes, much like the Ann Arbor Transportation Authority had undertaken to gauge voter receptivity to a possible countywide transportation millage. [Results of the AATA study are to be presented at a special meeting of the AATA board on Tuesday, Dec. 8.] Stephen Rapundalo (Ward 2) stressed that per the city charter, the city income tax could not be an “add-on” as in some other cities. The Ann Arbor city charter specifies that the city may levy a general operating millage or a city income tax, but not both.

CFO Tom Crawford emphasized that the idea of a city income tax was more significant than a change in revenue levels. It would completely restructure the way the city is financed. Prompted by Christopher Taylor (Ward 3) to clarify, Crawford said that in addition to new kinds of staff – auditors, collectors, form processors – there would be impacts to basic policy. One of the financial policies that would need to change if the city were financed through an income tax, said Crawford, was that reserve fund levels would need to be kept about twice as high as they are under a property tax funding mechanism. That’s because the precision of forecasting revenue levels is not as great with an income tax as with a property tax.

Fraser and Crawford also pointed out that an income tax did not represent a revenue panacea, with the extra amount of money compared to a property tax falling in the range of $8-10 million. [Chronicle coverage of the city income tax study released last summer: "Ann Arbor City Income Tax Study"]

Fraser also noted that an income tax meant there would be a different set of stakeholders in the city government who might have questions about how their tax money was being spent – the set of property owners overlaps with, but is a separate set of people from, city income taxpayers.

Current Revenue Projections with a Property Tax

Projections for future revenues for budgeting purposes assumes the city will continue to be funded through property taxes, not through an income tax.

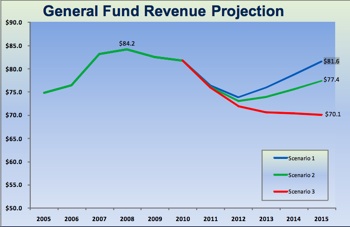

Ann Arbor general fund revenue projections. The optimistic scenario in blue puts revenues at $81.6 million in 2015 after a peak of $84.2 in 2008. The red, worst case forecast puts revenues at $70.2 million in 2015.

Fraser stressed that the revenue projections being used by the city for future budgets do not change the need to cut over the next five years.

Even under that most optimistic scenario, in 2015 revenues would only be $81.6 million, after an $84.2 million peak in 2008.

The worst case projection – one that assumes the complete collapse of the auto industry – would put the 2015 revenues at $70.1 million.

Rethinking Services

Service area administrators gave the council a preliminary rundown of the keys issues facing the city, from the city staff perspective. Those issues ranged from infrastructure issues like Argo Dam and the Stadium Boulevard bridges to the reorganization of the Housing Commission and the impact of the overall economic downturn on the planning department.

The council then divided into three smaller groups in separate rooms, and three groups of staff rotated through each room for a more detailed discussion. Staff group I: Sue McCormick, public services area administrator. Staff group II: Jayne Miller, community services area administrator and Barnett Jones, safety services area administrator; Staff group III: Roger Fraser, city administrator; Tom Crawford, chief financial officer; and Stephen Postema, city attorney.

The Chronicle observed the council group consisting of Stephen Rapundalo (Ward 2), Christopher Taylor (Ward 3), and Margie Teall (Ward 4). That group anticipated the discussion that was to happen in the afternoon, and focused on the list of ideas staff had put together for rethinking the basic kind of services that the city should provide and the way that the city should provide them.

Below is some annotation of the list of ideas that was meant to spur the council to start thinking in a fundamentally different way about city services. Fraser stressed that the items on the list were not recommendations, but rather a way for staff to get feedback on which ideas were worth pursuing.

Of the ideas, three seemed to receive almost no traction: outsourcing legal services, contracting with the county for police and emergency services, and the elimination of the DDA. While there seemed to be no great enthusiasm for any of the ideas, councilmembers were in general receptive to receiving additional, specific information.

In annotating the list, we combine the small group interaction we observed with the afternoon discussion of the list by the whole council.

Require leaves to be bagged by residents

Leaf collection and snow removal were identified by councilmembers as two areas generating a large volume of constituent complaints. Snow removal generated some animated discussion between Stephen Rapundalo (Ward 2) and public services administrator Sue McCormick. It emerged as a result of a discussion of Act 51 (gas tax) money.

Sue McCormick (left), public services area administrator, and Jayne Miller (right), community services administrator.

McCormick explained that leaf collection was previously paid for out of Act 51 (gas tax) money, but staff recognized that it was more appropriately paid out of the solid waste fund. Act 51 pays for street sweeping, snow removal, crack sealing, and traffic studies, McCormick said. Rapundalo asked if there was any flexibility for allocating more of the money for snow removal – perhaps eliminating the 5% earmark of Act 51 money for non-motorized transportation infrastructure.

Rapundalo, citing his northern Ontario roots, described snow removal in Ann Arbor as “abysmal.” McCormick countered with her own bio, growing up in the Upper Peninsula, and explained that small pickup trucks were not used to plow snow on city streets, because they would be subjected to mechanical stress they’re not designed for. She suggested that in approaching field operations staff, who manage snow removal, a useful approach for Rapundalo would be to query: “Why do I observe this?”

The leaf collection program has residents rake leaves into the road shortly before scheduled collection via front-end loaders and dump trucks. Because of the unpredictability of the leaf drop in any year, McCormick said, “I think we perform it poorly. We cannot do it well.” She put the annual cost of the program at around $400,000. That number, however, did not reflect the actual cost of the program, because the street sweeping associated with it sometimes was delayed until the following year – which meant that the street sweeping was not associated with leaf collection from an accounting perspective.

Eliminating the leaf collection program would have consequences for the collection of compost material, a service which the city provides using a combination of paper bags and carts – elimination of the program would not translate into a savings of $400,000. Mayor John Hieftje remarked that the compost carts can hold a prodigious amount of leaves, especially if they’re compacted by standing on them.

McCormick indicated that probably in January, staff would be bringing forward a recommendation to convert the city’s composting facility to a merchant operation, similar in spirit to the city’s material recovery facility.

Stop general fund support for golf

The park advisory commission got a recent update on the progress being made to put the city’s two golf courses, Leslie and Huron Hills, on stable financial footing. [Chronicle coverage: "Parks Update: Golf, Birds, River Art"]

At Saturday’s retreat, Miller said that compared to a general fund allocated subsidy of $589,000, the golf courses had used $460,000 – so the trend was in the right direction, but the subsidy required was still substantial. Of the two courses, Leslie is showing more improvement, enhanced by receiving a liquor license from the city in 2008.

When the focus then came to rest on Huron Hills Golf Course as the less profitable of the two courses, Stephen Rapundalo lamented: “Here we go again!” It was possibly an allusion to the contentious general election Rapundalo only narrowly won against write-in challenger Ed Amonsen in 2007, when a central issue had been the question of whether the city intended to sell Huron Hills.

Miller said that closing Huron Hills for golf would not mean that it would stop losing money. Even keeping up the property at some basic level of maintenance (not as a golf course) would require a considerable ongoing expenditure, she said.

Hieftje summarized by saying, “I think we’ll have golf.”

Institute street lighting special assessment districts

As recently as 2007, the idea of a street lighting special assessment district has been proposed. On that occasion, the Ann Arbor DDA paid the city about $630,000 to delay and reduce a street light tax that would have been assessed on downtown property owners. That tax would have generated around $170,000 annually.

The idea now under consideration would generate $1.5-2 million annually from property owners citywide paying an additional tax to fund street lights. Sue McCormick, public services area administrator, said that one way to configure the special assessment district would be to provide some basic level of lighting standard, with additional levels of service funded through the assessment.

A complicating factor is that some of the street lights are owned by DTE and others are owned by the city of Ann Arbor. The possibility of buying out DTE was briefly discussed. Another challenge is that the energy efficiencies gained from street lights are not as highly valued by DTE as one might expect, because the energy savings from street lights come mostly during an off-peak load time (at night), when DTE has excess capacity anyway.

Reduce or re-purpose general fund support for AATA

The city of Ann Arbor currently levies a 2.5 mill tax – adjusted by the Headlee Amendment to a rate of just over 2 mill – which the city charter specifies for the purpose of “providing funds for operating and equipping a public transportation system for the City.” That money is allocated to the Ann Arbor Transportation Authority.

As CFO Tom Crawford pointed out, the charter obligation is to spend the taxes collected under the transportation tax on transportation, not necessarily the AATA.

In connection with current discussions by the AATA of proposing a countywide transportation millage, the question becomes: What happens to the existing public transportation tax? One extreme would be to leave it in place and to continue allocation of that money to the AATA. The other extreme would be to eliminate the city transportation tax entirely, which would put Ann Arbor property owners’ contribution to the possible countywide transportation system on the same footing with other county residents. [Chronicle coverage: "AATA Adopts Vision: Countywide Service"]

Or it’s possible to contemplate a reduction in the city’s transportation tax, with the reduced percentage remaining on the tax bill, but reallocated elsewhere in the fund. Any of those options would require a ballot question put before the voters.

Reduce solid waste millage

On this proposal, the city would get out of the business of garbage collection, but stay in the business of recycling. The city would contract with a waste hauler, which would then be paid directly by residents under some kind of franchising arrangement that would allow them to “pay as they go.” That would allow a reduction in the solid waste millage, which could be passed along to residents. Or voters could be asked to continue to pay the same percentage, but direct to other areas the part not needed to fund garbage collection.

When considering whether residents would choose to continue paying the same amount even though their service had been reduced, and then pay again separately for waste hauling, Stephen Rapundalo asked, “Why would they do that?”

Stephen Kunselman (Ward 3) cautioned that this kind of “pay as you go” system could have the unintended consequence of encouraging the dumping of trash wherever people could find a place – something he said he’d seen as administrator of Sumpter Township in the early 2000s.

Defer uncommitted capital improvements

Councilmembers wanted to see a list of the improvements to be deferred. In connection with discussion of the Stadium Boulevard bridge replacement, scheduled to begin construction after the 2010 University of Michigan football season, Sue McCormick was also asked to provide a list of the street reconstruction projects that would be delayed, if the bridge replacement has to be paid out of the local street reconstruction millage.

Eliminate human services funding

The roughly $1.1 million in human services funding is currently allocated to area nonprofits based on a scoring metric. [Chronicle coverage: "Ann Arbor Allocates Human Services Funding"] In response to councilmember queries, it emerged that few cities fund any kind of human services. Sabra Briere (Ward 1) noted that Ypsilanti had eliminated human services funding a decade ago.

Stephen Rapundalo (Ward 2) wondered how much good some of the smaller allocations actually did, and questioned: “Are we having an impact?” Responding to Rapundalo, Briere – who works for the nonprofit The Corner Health Center – was emphatic: “I want to tell you, you are!”

In discussions of cutting back human services funding, Mayor John Hieftje warned that it would mean the elimination of some nonprofits. He said it would be important to bring together the city, the United Way, the Ann Arbor Area Community Foundation and other organizations to figure out a coordinated strategy for determining which ones survive.

Briere added that the role of nonprofits needs to be acknowledged: “We need to say out loud: This is not the government’s role alone. We do this in partnership with nonprofits.” On the subject of human services funding, Briere said it was impossible to call it a core service: “That’s why the amounts are so tiny.”

Look at various aspects of parks

While the council was unenthusiastic about any of the possible ways to save money in the parks system, they generally wanted staff to provide more concrete numbers on various scenarios. Information on the greenbelt millage was also requested: How much of the money is already obligated? Any change in that 30-year millage would need voter approval.

- Close recreation facilities: The financial benefit to closing recreational facilities, community services area administrator Jayne Miller pointed out, was not anywhere near the full cost of operating the facilities. Buhr Park, for example, requires $300,000 to operate. But it also generates $250,000 in revenue. To reach significant savings, several facilities would need to be closed. In addition, said chief of police Barnett Jones, decreasing recreational opportunities for young people would lead to increased property crimes. The same rationale applies to the potential closing of neighborhood centers (Bryant and Northside) – there was no interest in closing those centers. After the neighborhood centers, the biggest money losers (setting golf aside) are Mack Pool and the Senior Center. [Chronicle coverage of the task forces working on those two facilities: "Task Force Floats Ways to Save Mack Pool" and "Seniors Weigh in on Fate of Center"]

- Eliminate general fund support for parks system: Currently, mowing for parks is paid for out of the general fund. There is community pressure, Miller said, to treat the mowing of parks as a core service, hence it’s paid out of the general fund.

- Discontinue maintaining some parks: The key question identified by councilmembers was: Which parks and how much would it save?

- Sell some parks: It was noted by councilmembers that there would likely be little support on council for the sale of any parkland and that by a charter amendment passed in 2008, the question would need to be put to the voters. But the question of which parks might be candidates for sale was left on the table.

- Rescind parks budget reduction resolution: The city resolution, passed in 2006 in conjunction with the combined parks capital improvements and parks millage, keeps parks funding on par with other general fund allocations. So whatever percentage decrease there is in the general fund budget, there would maximally be a corresponding allocation of money to the parks and recreation system. If the general fund budget drops 3%, the amount of money the city allocates to parks can’t go down by more than 3%.

- Contract with Washtenaw County for parks services: Miller said that in the past, the reception from the county had been cool, but it might be worth trying again. She said that the Ann Arbor Public Schools had always been reluctant in the past to discuss the arrangement between the city and the schools on Mack Pool, but there’d been new-found cooperation – the same might be true of the county, she suggested.

Contract with Washtenaw County for emergency management, police services

Chief of safety services Barnett Jones said that when he worked for the Oakland County sheriff’s department, it was actually his job to put on his brown uniform with all of his regalia, and to sell safety services to the townships.

He could do that, he said, because the sheriff’s department was the best provider of safety services in Oakland County. The best provider of safety services in Washtenaw County, he said, already worked for the city – the Ann Arbor police department.

Among councilmembers there was no discernible interest in exploring the possibility further.

This is an issue independent of the various regionalization efforts at cooperation among various jurisdictions that Jones ticked through as “in action”: SWAT, K-9, hostage negotiation, dispatch, and training.

Outsource city legal services

Tony Derezinski (Ward 2), an attorney, said that the trend was actually in the opposite direction, not just for municipalities, but for corporations – organizations are bringing their legal work in house, because it is more cost effective and there is a greater ability to control the work. Stephen Rapundalo (Ward 2) also expressed a lack of enthusiasm for further exploration of the idea, saying it was a “non-starter.” However, city attorney Stephen Postema offered to provide any information and analysis that might be requested. It seems unlikely that the outsourcing of more of the city’s legal work will be explored further.

The idea of outsourcing information technology services was also briefly floated, but did not achieve much traction – largely because the city’s IT department is organizing itself in concert with the county in an effort at regionalization.

Eliminate the DDA

The city’s CFO, Tom Crawford, pointed out that the TIF (tax increment financing) revenue captured by the city’s Downtown Development Authority in its defined district comes from several different taxing authorities: the schools, the Ann Arbor District Library, the county and the city of Ann Arbor. So in thinking about how much revenue might be available to the city’s general fund, the starting point would be just the amount of city taxes captured by the DDA. Factored into the equation as well, he said, was the debt currently owed by the DDA. [More background in previous Chronicle coverage: "Who's on the Committee?"] Still, Crawford concluded that there could be a net annual gain for the city’s general fund of $700,000.

Mayor John Hieftje suggested that one alternative to dismantling the DDA would be to have the city council function as the DDA board, saying that in his view the DDA existed to work in concert with the city. [It's not clear if this is possible, based on the enabling legislation that allows for creation of the DDA.]

Stephen Rapundalo (Ward 2) declared that he was not interested in exploring the elimination of the DDA, given the strong opposition he anticipated there’d be.

[It's worth noting that another TIF-funded entity, the Local Development Finance Authority, is not a candidate for providing additional city general fund revenue, because the taxes captured by the LDFA come exclusively from the schools, not from the city.]

Change the way fire protection services are delivered

As head of safety services, Barnett Jones spoke about the impact of laying off 14 of the city’s 94 budgeted firefighter positions. He characterized the consequence as requiring a major restructuring of how fire protection service would be delivered, and it would require some outside-of-the-box thinking. He discussed “rolling brownouts,” which would close some stations on a rotating basis. Jones said that if the city went ahead with the layoff of 14 positions, he thought one or two stations would likely be closed.

The most likely scenario would be that stations in the outer reaches of the city would remain open, based on the principle that “it’s easier to come in than to go out.” Tony Derezinski (Ward 2) was keen to understand the potential impact of station closures on commitments Ann Arbor has with surrounding communities. Jones acknowledged that Station #4 was part of a functional fire service district with the city of Ypsilanti.

Ward 3 councilmember Christopher Taylor, right, and Stephen Rapundalo (Ward 2) discuss fire protection for the University of Michigan after hearing from safety services chief Barnett Jones on the subject.

Stephen Kunselman (Ward 3) raised the issue of the state’s fire protection grant, which is meant to provide funding to municipalities charged with the responsibility of fire protection for state institutions located within their boundaries – like the University of Michigan. City administrator Roger Fraser said that the state’s formula for appropriate funding came out to $1.8 million, but that the state provided only $900,000. That actually represented an increase from $300,000, which the state had paid historically.

But the extra funding, Fraser warned, had come from fines that had been established to punish severe traffic offenses, which were in the $500-$1,000 range. And there was a bill pending in the state legislature that would cut those fines, because they were deemed to be excessively harsh.

Stephen Rapundalo (Ward 2) wondered if the University of Michigan had been approached directly in light of its recent acquisition of 174 acres from Pfizer. The physical area, Rapundalo allowed, did not represent new fire protection responsibility, but the university would not be paying property taxes on the parcel as Pfizer had.

Jones cautioned that the university should not be approached too aggressively on that front, because the university had the ability to provide its own fire protection, parallel to the way it has provided its own department of public safety. Christopher Taylor (Ward 3) asked why this would be perceived as a negative. Jones suggested that the city wanted to be the entity that provided the fire service in the area – but it wanted to be funded to do it.

Short Term: Firefighters and Integrated Funding

The short-term challenge, however, is not in rethinking the ways that city services are delivered. There’s a $3 million shortfall in the current FY 2010 budget that requires action, said city administrator Roger Fraser. What Fraser is proposing to begin enacting the week of Dec. 7 is as follows:

Immediate Changes for Mid-FY 2010

Recurring Savings

$ 125,000 eliminate contingencies

38,707 elimination of temporary-contracted

crews/non-park tree removals

259,001 transfer stump removal, tree planting

from general fund to stormwater (requires council action)

45,360 eliminate hand trimming with mowing

98,000 change mowing cycle for parks from 14 to 19 days

811,475 do not fill extra police vacancies from

the early-out program

206,000 adjustment to total compensation

1,583,543 total recurring

Non-recurring savings

$ 135,000 lower-than-budgeted losses for golf courses

5,000 decrease in temporary staff time

500,000 tax refunds budgeted for Pfizer but settled

in prior year

90,000 eliminate vacancy in budget office

23,875 decrease in conference, training and travel

10,000 don't fill anticipated facilities vacancy

slated for April 2010

28,000 new estimates for energy savings on utilities

for rec facilities

396,803 fire personnel reductions - planned

reductions advanced to Jan. 2010

10,000 reduce contribution to the Ann Arbor Affordable

Housing Trust Fund by 10%

250,000 eliminate Joint Integrated Funding

1,448,678 total non-recurring

$3,032,221 total recurring & non-recurring savings

-

Of these items, the most concern among councilmembers was expressed about eliminating Joint Integrated Funding and laying off firefighters six months earlier than had originally been planned.

Joint Integrated Funding

What is Joint Integrated Funding? From a city press release in May 2008:

The Joint Integrated Funding project, which is coordinated by the City of Ann Arbor, Washtenaw County, Ann Arbor Area Community Foundation and United Way, in cooperation with the Washtenaw Housing Alliance, raises funds for an integrated approach to providing housing support services for low-income residents.

Jayne Miller said that given a choice between Joint Integrated Funding and other human services funding, Mary Jo Callan, who directs the city-county office of community development, recommended making the cut in Joint Integrated Funding. It had been a two-year pilot program. Sandi Smith (Ward 1) expressed concern that cutting the Joint Integrated Funding might simply shift the problem eventually to safety services. Sabra Briere (Ward 1) noted that human services funding was also still on the table to be cut.

Briere also noted that the city council had just recently approved emergency funding for additional sheltering capacity for the homeless in advance of the coming winter. [Chronicle coverage: "Council OKs Transit, Recycling, Shelter"]

Firefighter layoffs

Several members of the International Association of Firefighters Local 693 attended at least part of the budget retreat, including Matt Schroeder, who’s president of the local. Schroeder recently gave a presentation to the University of Michigan regents, in which he warned that pending layoffs would mean less fire protection for the UM campus. [Chronicle coverage: "Regents Get Update on Town-Gown Relations"]

Matt Schroeder, president of the International Association of Firefighters Local 693, left, and Stephen Kunselman (Ward 3).

Stephen Kunselman (Ward 3) declared that one of his priorities was preserving firefighter jobs and his priority for funding those jobs for another six months was to use the city’s economic development fund, which had been established in order to provide parking permits for Google employees – Google had made provision of the free parking passes a condition on their choice to locate offices of their AdWords division in downtown Ann Arbor.

Tom Crawford, the city’s CFO, quickly cautioned that funding operations from a savings fund would represent a “significant departure” from the city’s financial practice. Kunselman responded, saying that the staff had made clear to the council that there should be “no sacred cows.” Crawford replied that it was not a sacred cow that was at stake, but rather a standard financial practice.

The one situation when it might be possible “to get away with” funding operations out of savings, Crawford said, was if the city knew it was “at the bottom” and that the economy was on its way to recovery. Stephen Rapundalo (Ward 2) declared that he preferred to use the economic development funds for what they were intended. Margie Teall (Ward 4) said she was also against using the fund for firefighter positions, saying it sent a bad message.

Kunselman said that the bad message being sent from the point of view of economic development was that the city would not be able to provide fire protection to downtown businesses – at which point city administrator Roger Fraser shot back: “That totally misrepresents the situation, Stephen!”

Mayor John Hieftje weighed in, saying one option that had been presented to the firefighters was an across-the-board wage cut in order to save some jobs – it was an idea that had not been embraced, he reported. Fraser confirmed Hieftje’s remarks.

Fraser then offered the council some perspective on his position at the bargaining table with the firefighter’s union. He said that the council’s unwillingness to face the need to change, and their willingness to continue to bail out the unions, lent credence to the union’s belief that they’d continue to be bailed out.

Kunselman questioned why the city’s relationship with its unions did not seem as healthy as the county’s. [Chronicle coverage of county union concessions: "AFSCME union concessions help, but other issues remain"] Fraser said that the county had not gotten any concessions from its Act 312 unions.

Michigan’s Act 312 outlines requirements for compulsory arbitration of labor disputes for police and fire departments. In a recent arbitration case involving the Ann Arbor Police Officers Association, the arbiter ruled in favor of the union, and the city council needed to appropriate an additional $673,000 to cover the settlement cost.

At the budget retreat, the city’s head of human resources, Robyn Wilkerson, said that while the benefits provided to the unions were perceived as generous, it was important to recognize that the deciding opinion in these matters was the arbiter.

Sandi Smith (Ward 1) requested some information on standards for staffing levels, saying that she still had great discomfort making a decision without a fire chief in the room to provide assurances that fire protection staffing standards and response times would be met. She said she recognized that there was likely little support on the council for delaying the layoffs, but wanted to leave her objection on the record.

Carsten Hohnke (Ward 5) noted that there was actually enough in the general fund reserve to plug every hole in this year’s budget, but that he was not in favor of “kicking the can down the road.”

Based on the budget retreat conversation, councilmembers will seek some clarification at their meeting on Dec. 7 about what fire protection service will look like with 14 firefighter layoffs, but they are unlikely to stop the layoff notices from being sent out in the week following the meeting.

Sabra Briere summed up the retreat when near the end she declared: “We are going to have a serious austerity budget.”

Section: Govt.

The following terms describe the content of this article. Click on a term to see all articles described with that term: Ann Arbor City Council, city budget, firefighters, human services, millage, recurring savings